Stocks for day trading

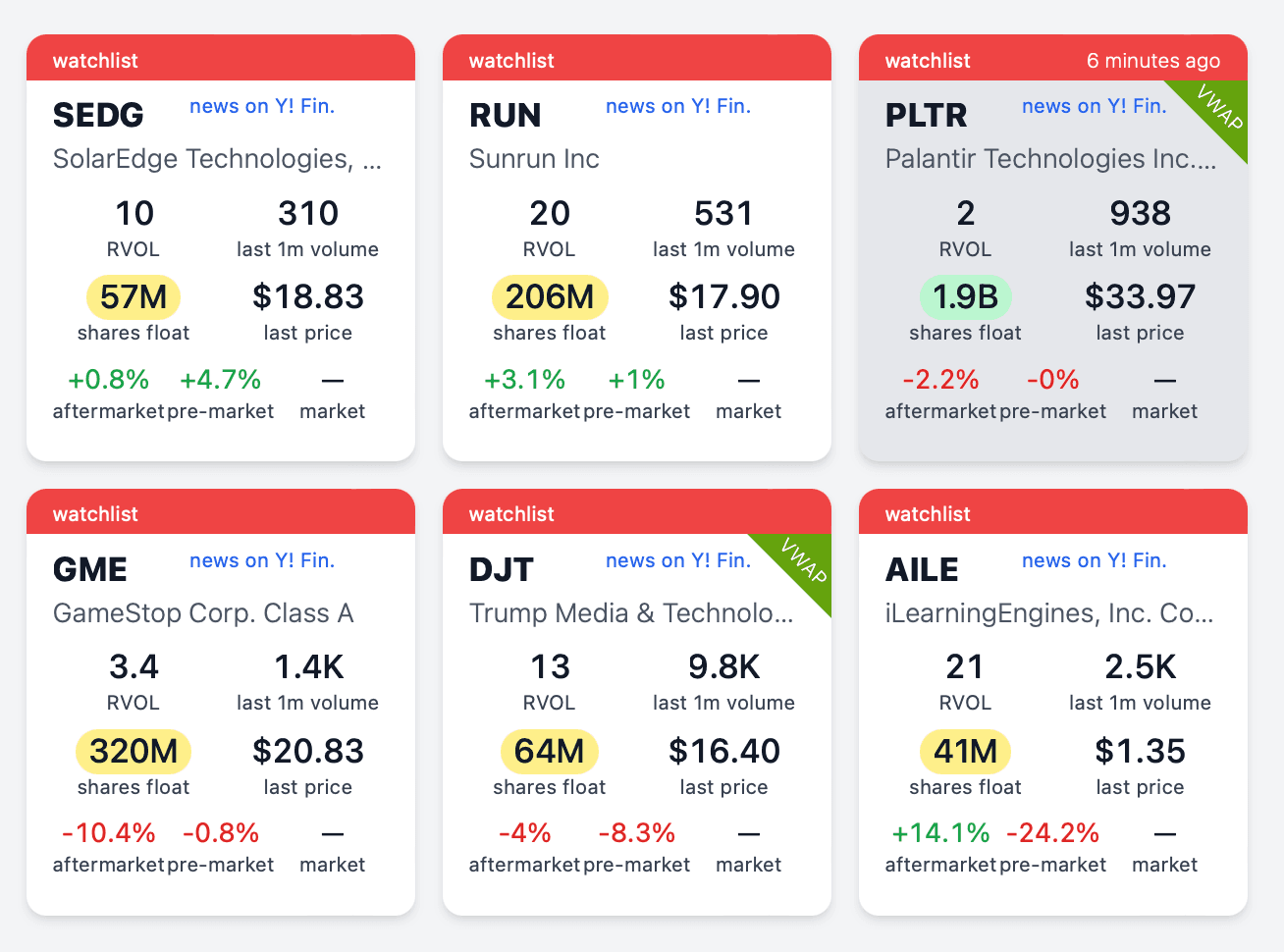

A real-time updated list of stocks in play on the US stock market for day trading.

90% of day traders fail because they're trading the wrong stocks

“You can have the best platform and tools and be a master of many strategies, but if you are trading the wrong stock, you will definitely lose money.” — Andrew Aziz in his book How to Day Trade for a Living

Hours spent looking for the right stocks to trade

Tedious analysia of data from different websites

Missed day trading opportunities and finally give-up on trading

Supercharge your day trading, target the right stocks, make $

Market Volatility

Day trading relies heavily on price movements within a single trading day. Stocks that are too volatile can be risky, while those that are not volatile enough may not provide sufficient profit opportunities.

Pricing

Save hours of searching for the right stock to trade!

Access to Stocks in Play

Are you ready to take your day trading to the next level? This is the ultimate destination for discovering the best US stocks for day trading.

$25

$19

USD / month

- Real-time alerts

- The hottest stocks to watch

- Act quickly and confidently

- Never miss a trading opportunity again

FAQ

Frequently Asked Questions

Our algorithmic scanning software generates alerts that are of interest for day traders, not for investors. We do not provide financial advice or investment advice. Our alerts surface stocks in play. A Stock in Play moves, and these moves are predictable, frequent, and catch-able.

The alerts notify you of stocks exhibiting unusual activity, indicating a volatile state. Day traders often seek out such volatility, making these alerts valuable if acted upon correctly. However, it's essential to conduct your own due diligence and analyze the stock's graph before making any decisions. Depending on your analysis and risk tolerance, determine whether to buy, sell, or hold the stock.

No, our testing, including back-tests, has shown that blindly following alerts without thorough analysis does not yield consistent results. Conduct a comprehensive technical analysis and due diligence before making any trading decisions. Look for patterns and monitor support and resistance levels. Only enter positions when you have a clear understanding of the stock's movement dynamics.

Not necessarily. While some alerted stocks may experience upward movement, others may decline. Predicting stock movements with certainty is challenging. Be cautious of pump and dump schemes, which can artificially inflate prices before rapidly deflating them. Consider factors such as the stock's free float and conduct thorough analysis to mitigate risks.

No, it's essential to adapt your strategy based on market conditions and the specific stock's behavior. While we typically identify stocks primed for upward movement, be mindful of overbought conditions and potential reversals. Consider shorting stocks when support levels are breached and a reversal trend is indicated. As always, conduct thorough analysis and due diligence before making any trading decisions.

Alerts are sent out in real-time as our algorithm identifies stocks meeting our criteria for unusual activity. However, the frequency of alerts can vary depending on market conditions and the availability of suitable opportunities.

At this time, we provide standardized alerts based on our algorithm's criteria. However, we continuously evaluate feedback from our members and may consider implementing customization options in the future.